We now offer Virtual Mediations using Enhanced Video Conferencing

Originally published: April 2025

Facing a Florida divorce doesn’t mean you have to lose your hard-earned financial stability along with your marriage.

While Florida law requires the division of marital assets, there are ways to make this process less painful.

You can protect your financial future during a divorce by taking strategic steps to organize your finances, understand your rights, and consider alternatives such as mediation.

Many couples find that opening separate bank accounts and focusing on long-term financial planning helps them maintain independence while dividing their assets.

While you can’t completely avoid dividing assets during a Florida divorce, you can minimize financial stress through proper preparation.

Considering alternatives to contentious court battles can also preserve both your assets and peace of mind.

Prenuptial or postnuptial agreements offer protection, while mediation provides a less adversarial environment to navigate your financial future.

Florida divorce law provides specific guidelines for dividing property, aiming to be fair, although not necessarily equal.

Understanding these frameworks can help protect your financial interests as you navigate this challenging process.

Florida follows the principle of equitable distribution, which means that courts fairly divide marital assets, rather than automatically splitting them in a 50/50 manner. The judge considers several factors when making these decisions:

Your specific situation matters greatly. For example, if you supported your spouse through graduate school, the court may recognize this contribution when dividing assets.

Remember that “equitable” means fair based on your unique circumstances. This gives you room to negotiate a settlement that acknowledges your specific contributions and needs.

Understanding what property is subject to division is crucial for protecting your financial future. Here’s how Florida distinguishes between assets:

Marital assets (subject to division):

Non-marital assets (typically protected):

Timing matters greatly. That home you purchased three months before your wedding? Likely, your separate property. However, if marital funds were used for mortgage payments, it may become partially marital.

Professional asset valuation is often worth the investment to ensure the fair treatment of complex property, such as businesses or investments.

Debts follow the same equitable distribution principles as assets in Florida divorces. This means liabilities acquired during marriage are typically considered shared responsibilities.

Common marital debts include:

Protect yourself by compiling thorough financial documentation as early in the process as possible. This includes credit reports, loan statements, and payment histories.

Be especially careful with joint accounts during separation. You may remain legally responsible for debts your spouse accumulates even after filing for divorce. Consider freezing joint credit lines when appropriate.

For debts attached to specific assets, courts typically assign responsibility to the person receiving that asset.

If you keep the family home, you will likely take on the mortgage as well—an important consideration when negotiating your property settlement.

Starting to worry about dividing your assets? Ann Goade, Esq, offers private divorce mediation in Stuart, FL—so you can protect your finances and peace of mind from day one. Schedule your appointment now.

If you’re ready to get started, call us now!

Mediation provides a more peaceful approach to dividing assets during a Florida divorce.

Understanding how to approach your financial discussions can help you protect your future while maintaining a collaborative atmosphere.

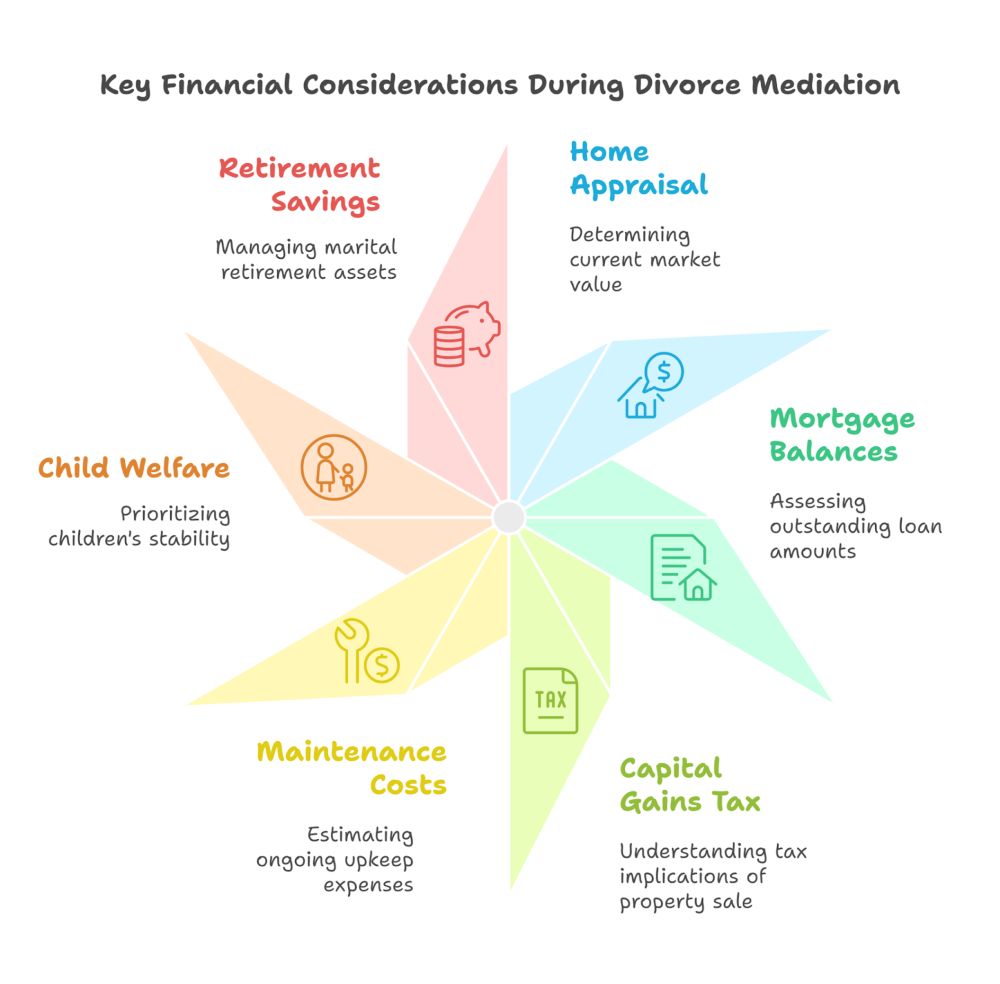

The family home often represents both financial and emotional value. In Florida, property division involves determining a fair allocation of both assets and debts.

Your options typically include:

Get a professional appraisal to determine the home’s current market value. Before deciding who gets the house, consider mortgage balances, potential capital gains tax implications, and maintenance costs.

If you have children, courts often favor arrangements that minimize disruption to their lives. However, keeping the home isn’t always financially wise if maintenance and mortgage payments strain your post-divorce budget.

Your retirement savings represent a significant portion of your marital assets. These accounts require special handling to avoid unnecessary penalties and tax consequences.

Key points to remember:

Be cautious about trading retirement assets for other property. While $100,000 in home equity might seem equal to $100,000 in retirement funds, the tax implications make them unequal in practice.

When considering retirement funds, focus on long-term budgeting. Consider your post-retirement needs and how the division will impact your financial security in the years to come.

Investments and business interests often complicate Florida divorces. These assets can be challenging to value accurately and may require the expertise of forensic accountants.

For business ownership:

Ensure accurate valuations while dividing income-producing assets. You can conduct your own appraisal to verify the presented values.

Be alert to signs of hidden assets such as unusual cash withdrawals, missing statements, or newly formed corporate entities.

Your mediator can help establish financial transparency to ensure all assets are properly disclosed before finalizing your agreement.

Remember that investment accounts may have different tax bases that affect their real value when liquidated.

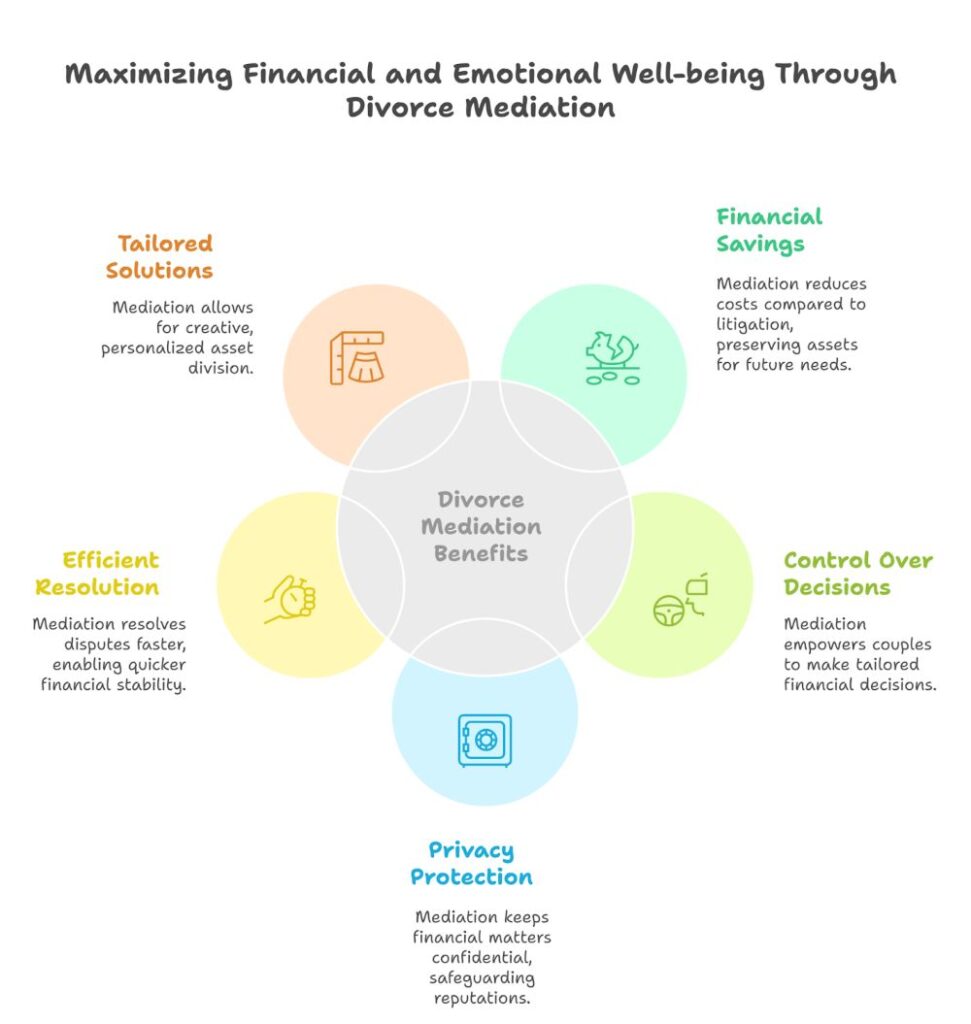

Choosing mediation for your divorce can lead to significantly better financial outcomes while protecting your emotional well-being.

This approach creates space for a thoughtful asset division that respects the needs and concerns of both parties.

When facing divorce in Florida, the financial impact of your chosen process can be substantial.

Court-connected mediation typically adjusts costs based on your income, making it accessible regardless of your financial situation.

This stands in stark contrast to litigation, which can quickly deplete the very assets you’re trying to divide.

Mediation typically requires:

Many Florida couples find they save thousands of dollars through mediation. Instead of paying for courtroom battles, you can preserve those funds for your new beginning or your children’s future needs.

The efficiency of mediation also means you can return to financial stability faster, without the lingering costs of prolonged legal proceedings.

Through divorce mediation in Florida, you maintain control over important financial decisions. This process promotes cooperation and reduces hostility during what could otherwise be contentious negotiations.

You can create customized solutions for:

Mediation allows you to think creatively about dividing property without court involvement.

For example, one spouse might keep the family home while the other receives equivalent retirement assets. This creates a balanced settlement that meets each person’s specific needs.

Your unique financial circumstances deserve tailored solutions that standard court formulas simply can’t provide.

Protecting your financial privacy becomes especially important during divorce. Unlike court proceedings, which create public records, private divorce mediation in Florida maintains the confidentiality of your financial matters.

This confidentiality offers several advantages:

Many professionals and business owners find this privacy essential to maintaining their reputation and business relationships.

Mediation creates a secure environment where you can discuss financial disputes honestly without fear of public exposure.

The confidential setting also encourages more transparent financial disclosures between spouses. This often leads to fairer agreements and fewer disputes about hidden assets in the future.

Whether you’re splitting the family home or negotiating retirement plans, let Ann Goade, Esq, guide your financial divorce process with clarity and calm through professional mediation. Contact us now.

If you’re ready to get started, call us now!

Proper financial organization before entering divorce mediation can save you thousands of dollars and countless hours of stress. The right preparation helps you negotiate from a position of knowledge rather than emotion.

A net worth statement provides a clear picture of your financial situation by listing all assets and debts. Begin by creating a comprehensive inventory of everything you own, both jointly and separately.

Assets to include:

Debts to track:

Use a simple spreadsheet to organize this information. Include current values for assets and remaining balances for debts.

This financial checklist for divorce in Florida can help you identify areas you might overlook.

Remember that assets acquired during marriage are typically considered marital property in Florida, regardless of whose name appears on the title.

Collecting financial documents early saves time and prevents delays in your mediation process. To organize everything, create a filing system, whether digital or physical.

Essential documents to gather:

Make copies of everything, as originals may need to stay with the primary account holder. During financial planning for divorce, it is crucial to create a post-divorce budget that accurately reflects your new financial reality.

Consider organizing documents chronologically and by account type for easy reference during mediation sessions.

Divorce involves both emotional and financial considerations, but keeping them separate helps you make more informed decisions. Focus on long-term financial security rather than short-term emotional satisfaction.

Steps to establish priorities:

You must also estimate your post-divorce monthly income from all sources. This includes salary, potential alimony or child support, investment income, and any other regular payments.

Be realistic about lifestyle adjustments. Many people find they cannot maintain the same standard of living after divorce. Prioritizing needs over wants helps protect your financial future.

Consider assets that may offer steady income or growth potential, rather than relying solely on emotional satisfaction.

Divorce brings financial hurdles that can feel overwhelming. Taking a strategic approach to common issues can help preserve your mental well-being while protecting your financial future.

When one spouse earns significantly more than the other, financial negotiations can become unbalanced. This power imbalance often leads to anxiety and unfair settlements.

What you can do:

A common mistake is accepting less than you’re entitled to out of fear or exhaustion. Remember that Florida law aims for equitable distribution. This doesn’t always mean a 50/50 split, but rather what’s fair based on various factors.

Don’t be afraid to ask for help. A mediator can level the playing field and reduce confrontation when income disparities exist.

Sentimental value can cloud financial judgment. You might find yourself fighting for items that cost more to keep than they’re worth.

Questions to ask yourself:

One of the biggest financial mistakes is fighting over items with little monetary worth. Couples often spend thousands in legal fees battling over possessions worth far less than they are.

Try creating three lists: must-haves, would-like-to-haves, and willing-to-give-ups. This approach helps you prioritize what truly matters to you emotionally rather than financially.

Consider photographing sentimental items you can’t keep. This preserves the memory without the financial burden.

Splitting the text into at most two sentences per paragraph.

Today’s settlement affects tomorrow’s financial security. Many people focus solely on their immediate needs rather than prioritizing long-term stability.

Key areas to consider:

Understanding asset values is crucial. Some assets that appear equal on paper have different long-term values.

For example, $100,000 in retirement funds isn’t equivalent to $100,000 in home equity when considering access and tax consequences.

Think about inflation and cost-of-living increases. What seems like adequate support today may fall short in five years. Building escalation clauses into agreements can prevent future financial stress.

Avoid rushing through the simplified divorce process without fully understanding the long-term implications of your financial decisions.

Splitting the text into at most two sentences per paragraph.

When facing divorce in Florida, finding the right mediator can make all the difference in how smoothly your asset division process unfolds.

Florida families across Stuart and the Treasure Coast consistently choose Ann Goade for her extensive experience, flexible mediation options, and ability to create tailored solutions for property division.

Ann Goade brings over three and a half decades of specialized family law experience to every mediation session.

As a Certified Family Law Mediator, she has guided countless Florida families through complex divorce negotiations with compassion and expertise.

Her deep understanding of Florida’s marital property laws helps you navigate the division of assets with confidence. You’ll benefit from her knowledge of local courts and procedures specific to the Treasure Coast region.

Ann’s extensive background means she is likely to have encountered situations similar to yours before. This experience allows her to anticipate potential roadblocks and suggest practical solutions before conflicts escalate.

When you choose Ann, you’re not just getting a mediator—you’re partnering with someone who understands the emotional and financial complexities of divorce.

Virtual mediation has become an increasingly popular choice for busy Treasure Coast families. With an internet connection, you can participate in productive discussions from anywhere, saving time and reducing stress.

For those who prefer face-to-face interaction, Ann’s Stuart, Florida office offers a neutral and comfortable environment for constructive conversations about asset division.

Regardless of the format you choose, Ann ensures each session maintains the same level of professionalism and confidentiality.

Her adaptable approach means you can choose the mediation style that best suits your unique circumstances.

No two marriages are identical, and Ann Goade recognizes that your financial situation deserves personalized attention.

She helps you create tailored property division agreements that address your specific assets and concerns.

Her approach to property division mediation emphasizes finding equitable solutions that both parties can agree upon.

You’ll work together to determine the fairest way to divide marital assets and debts.

Ann guides discussions about:

The openness and flexibility of Ann’s mediation process help you understand different perspectives and identify underlying interests.

This collaborative approach often leads to more satisfying outcomes than traditional litigation.

Don’t let financial stress control your divorce. Schedule your personalized mediation session with Ann Goade, Esq. today and create a fair, future-focused agreement that supports your next chapter.

What is equitable distribution in a Florida divorce?

Equitable distribution means marital assets and debts are divided fairly, but not always equally, based on each spouse’s circumstances. Florida law (§61.075) governs this process.

Are retirement accounts split in a Florida divorce?

Yes. Retirement accounts, such as 401(k)s, IRAs, and pensions, are typically considered marital property if they were earned during the marriage. A QDRO may be required to divide them.

Can we decide who keeps the house during mediation?

Yes. Mediation enables couples to agree on whether one spouse will buy out the other, sell the home, or co-parent while one remains in the home temporarily.

How are debts handled in a Florida divorce?

Debts are divided just like assets. Credit cards, loans, and mortgages are considered during mediation to achieve a fair and workable division of liabilities.

What happens if one spouse earns much more?

Income disparity can impact the division of assets and discussions about support. Mediation offers a safe space to address financial imbalances with neutral guidance.

Is financial mediation cheaper than going to court?

Yes. Divorce mediation typically costs less than litigation. Many Florida couples save thousands in legal fees by resolving financial matters outside of court.

Do we need to hire a financial expert for mediation?

Not always. A skilled mediator like Ann Goade, Esq. helps couples clearly navigate asset division. In complex cases, a financial advisor may be consulted jointly.